Currently in a swing trade average entry at 8337. At the moment price is lingering at the entry with no clear intention.

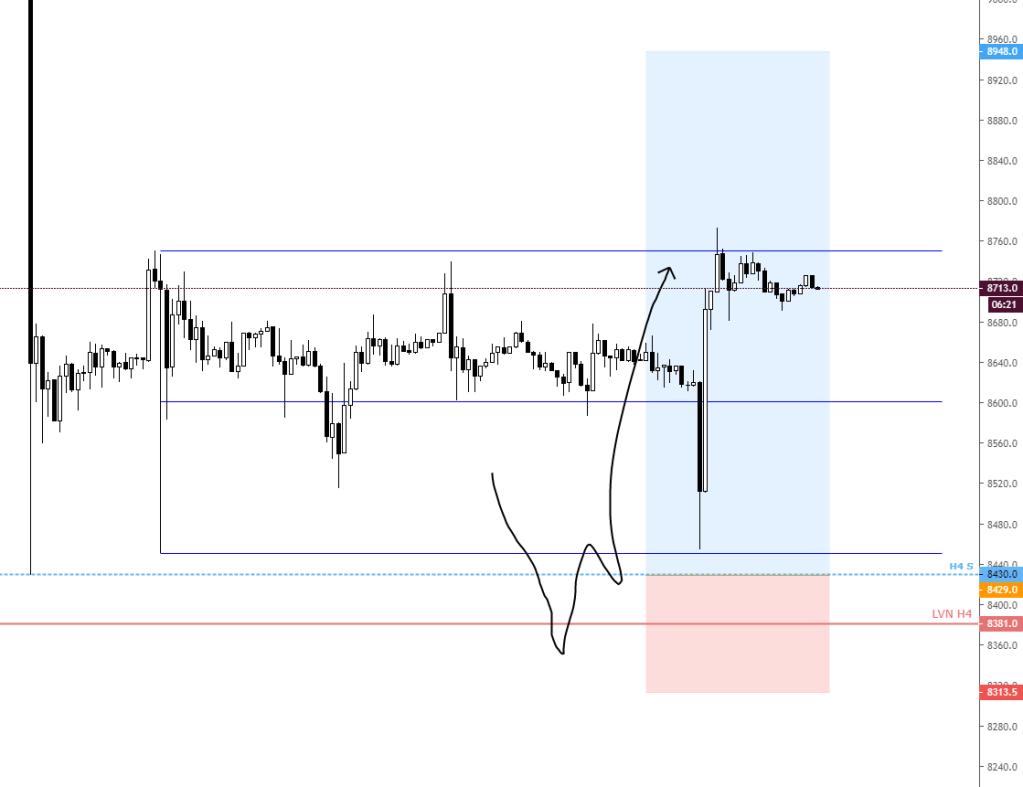

Missed trade 22 Jan

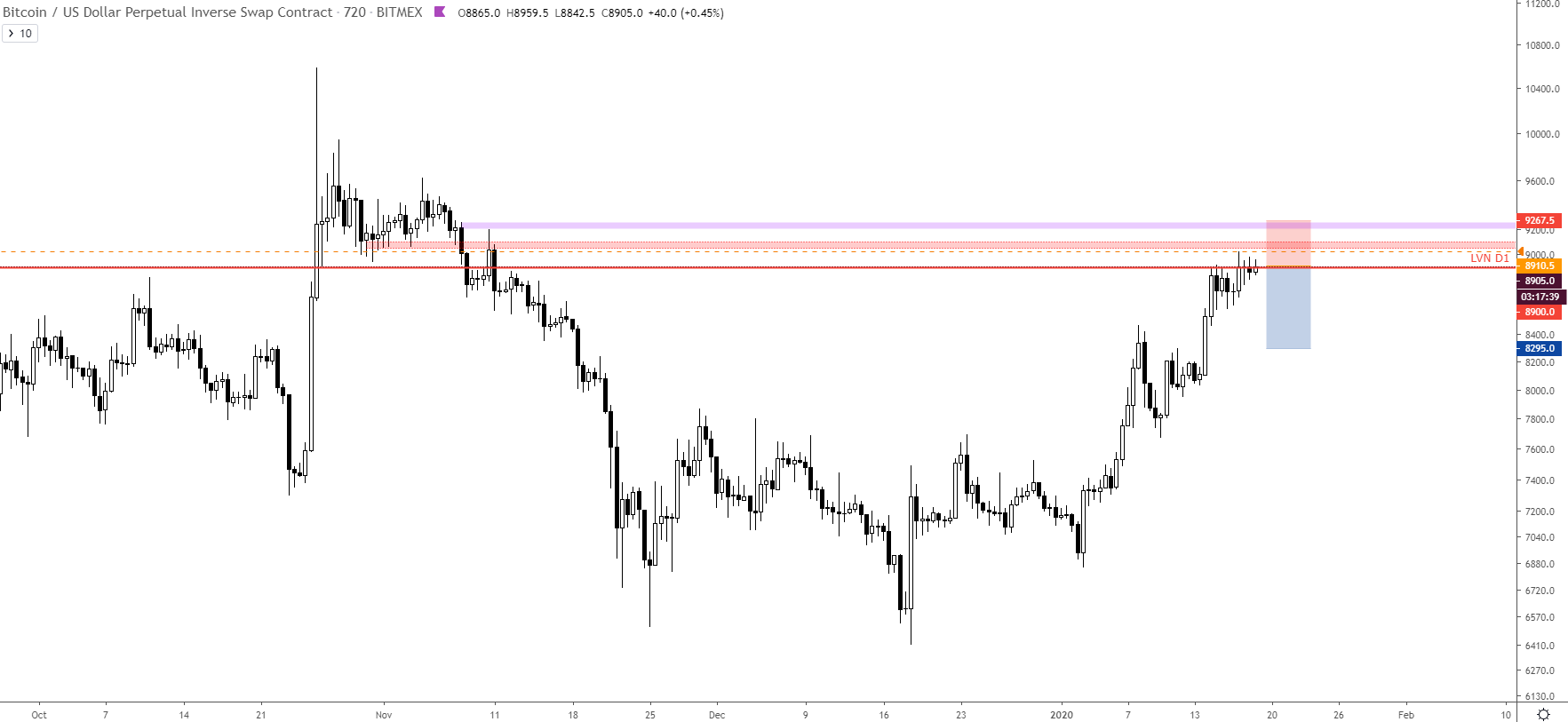

This is a trade that I had laid out in advance on my twitter account that I ended no taking. Original tweet: https://twitter.com/OvidiuPublius/status/1219608269586563073/photo/1

Since the initial plan price already traveled to the bottom of the range and was looking rather impulsive. Chart was like this when I decided that I will not take the short.

My thoughts at that time were: “Reacted to no apparent strong demand taking only 1 of the 3 obvious previous lows. I was almost ready to pull the trigger but it wasn’t according to the plan. I am not taking the short now since this is too impulsive. I have a bit higher a series of short limits on the swing account”

To be more exact I was talking about missing the long from range low the one that I covered here : https://bitcoininvestingjournal.finance.blog/2020/01/22/almost-a-trade/

Ended up being sort of a perfect trade had I taken it. But that is trading like, more misses and bad execution than perfect hit and runs

A few conclusions after the fact:

1 The trade idea was that price was in range and that it will either spike the top of bottom of the range get some liquidity and continue to the other side.

2 After price came so impulsively from range low the initial thesis was sort of invalidated reason why I did not take the trade

3 Sometimes it may be helpful in playing the setup without overthinking it

Almost a trade

Today is 22nd of January 2020 and this time last year I was entering my 6th month of trading as a serious undertaking. And exactly on this day the year before I was writing in my journal that I need to check out Cred’s trading manual. The main thing being that I was frustrated leaving winners transform into losers.

Today’s story is not about a winner nor a loser but about the third situation, the most frequent and the least talked about which is a missed trade.

Short story of price is that after a run up we just had a violent breakdown and now price was settling in a nice range waiting to break to either side. This trade plan was a very simple one and it had been made 2 days before. Essentially waiting for price to take out previous swing low created by the breakdown hitting 2 levels that were deemed important and then if price would reverse than enter long with first target range high.

I got the alert as prices was hurling down and was waiting for the spike which stopped short of hitting the swing low and then violently reversed taking out what I presume to be breakout short sellers.

Moral of this story is that as a trader you experience this situation far more often than any other situation.

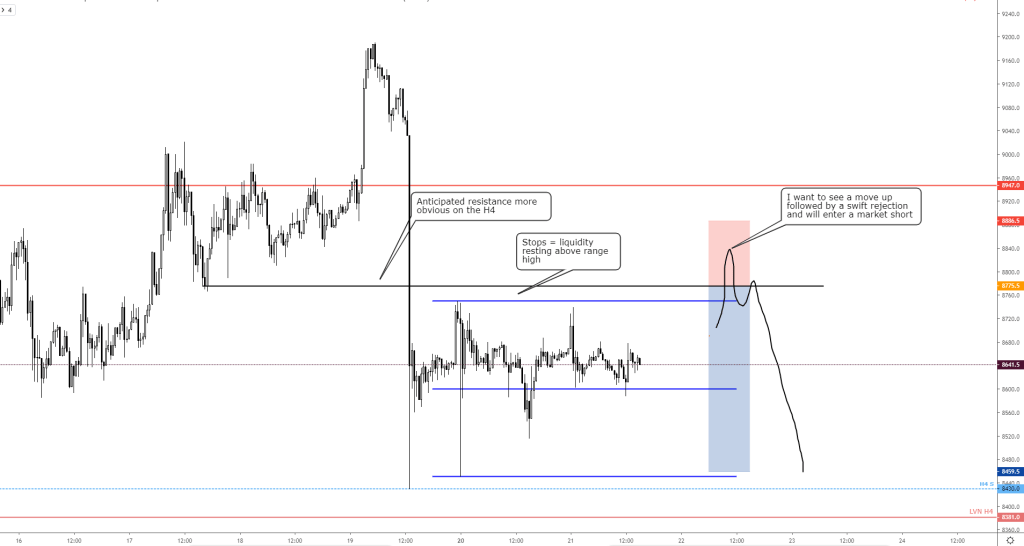

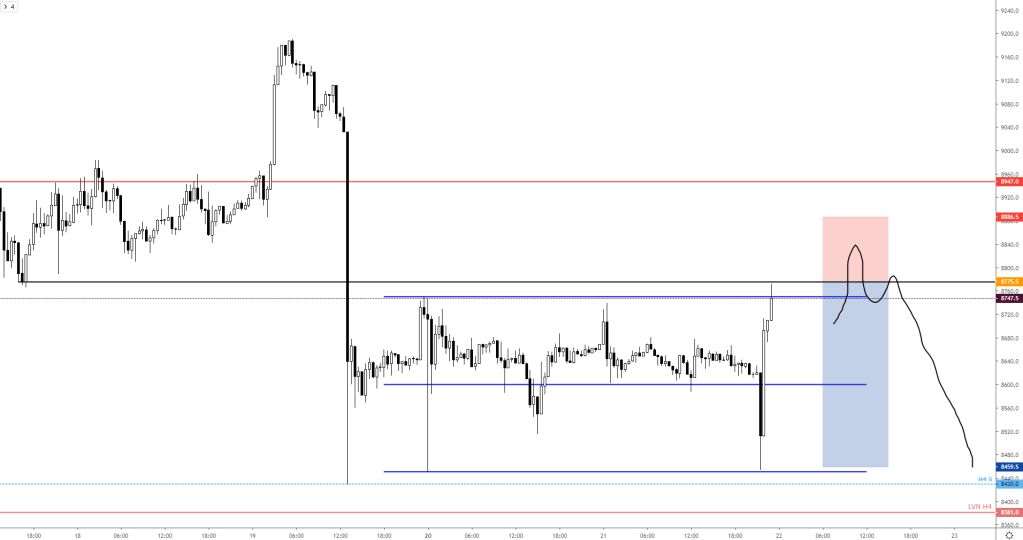

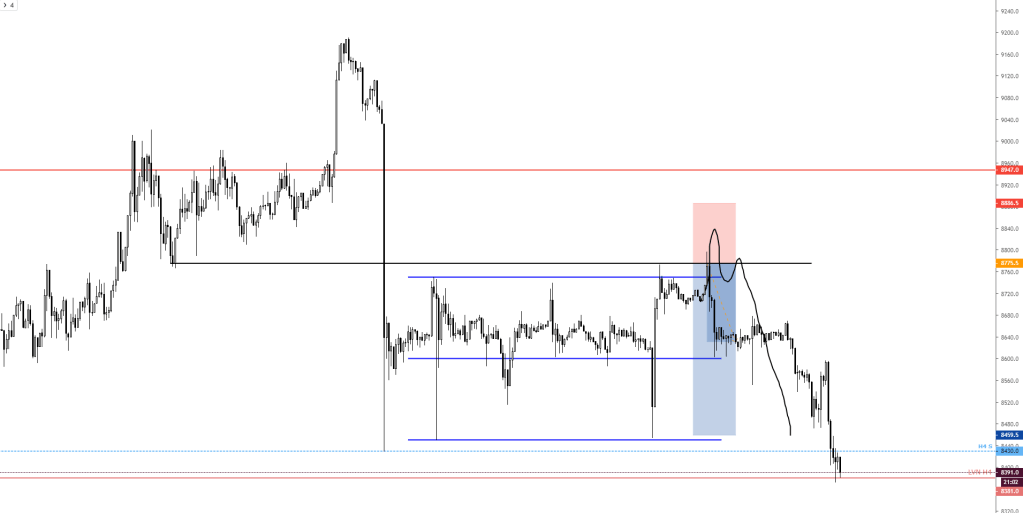

XBTUSD Swing Short live analysis 18 Jan 2020

Swing short view H12

Currently I am in a swing short that was posted initially on twitter. Reposting for consistency

“Second attempt to swing short here – 20% now. I have a generous SL (I think). I would be very happy if I could get some fills in the 9100-9150 area. Stoked on managing this one. Disclaimer: starting with second half of 2019 I royally messed up all my HTF trades (all were longs)”

Over night price spike well into supply and I wasn’t all that confident that I will not be stopped before the dump will come.

“Feeling like in the big short rn, “why is it not falling?” Will not add to my swing position. Seems like the better alternative was longing into resistance lol.”

A couple of hours later price was appearing weak on LTF so I decided to add to my short another 20%:

“Added another 20% at 9055 the rest I will only add after clear rejection like an SFP of the current swing high on the H1 H4 preferably or after breakdown of the 8900 level. otherwise this will remain may max position until stop out”

“Seems so obvious in hindsight doesn’t it… Took half of out of a 40% position and I will add some size on a bearish retest 8700-8900 area. Will now let this settle before doing anything else.”

Price seems to have established a range on the LTF and I don’t want to bet where the next move is going to be so I closed the position. Trade stats: Average entry 9001 Average closing 8658 Hard Stop was 9265 and tentative TP was 8528 but the initial plan was to hold it for a bit longer than I did. Realized R 1.3

Price Action Trading

This is a trading journal whit focus on BTC margin trading and occasionally some alts such as ETH.

If you are here then it means that probably you are also trading BTC or are interested in doing so.

Why do this?

- Because trading requires active journaling at least in the first years and because I think could be helpful to others that are starting out. I will try to show the realities of trading which is only possible through real time updates.

This could evolve in me trying to convey some of the things I learn, but primarily it will be about my own journey.